- Are all cryptocurrencies based on blockchain

- Do all cryptocurrencies use blockchain

- What is the market cap of all cryptocurrencies

Cryptocurrencies all

This money didn’t appear overnight. Their developers worked on them for years, and the Bitcoin was launched in 2009, starting this huge chapter, which is risky, unpredictable, but at the same time profitable and promising https://drying-machine.org/pokies/. Litecoin appeared a few years later, in 2011, followed by Ripple in 2012. Ethereum, which is one of the most recognized currencies, was launched in 2015, and just one year earlier the world met Stellar. In 2017 Bitcoin Cash was developed and launched, as a successor of the Bitcoin.

That’s why here at Masterworks, we make it easy to identify key details of an investment. We do the legwork for you (with some help from our expert research partners at Citi Bank and Bank of America) and then we make it possible to purchase shares in securitized multi-million-dollar artwork with all the information you need to make an informed decision. Ready to get started? Fill out your membership application today to learn more.

The information contained herein neither constitutes an offer for nor a solicitation of interest in any specific securities offering. For any proposed offering pursuant to an offering statement that has not yet been qualified by the SEC, no money or other consideration is being solicited, and if sent in response, will not be accepted. No offer to buy the securities can be accepted and no part of the purchase price can be received until the offering statement for such offering has been qualified by the SEC any such offer may be withdrawn or revoked, without obligation or commitment of any kind, at any time before notice of acceptance given after the date of qualification. An indication of interest involves no obligation or commitment of any kind. Offering circulars for Masterworks offerings are available here.

Are all cryptocurrencies based on blockchain

Solutions to this issue have been in development for years. There are currently blockchain projects that claim tens of thousands of TPS. Ethereum is rolling out a series of upgrades that include data sampling, binary large objects (BLOBs), and rollups. These improvements are expected to increase network participation, reduce congestion, decrease fees, and increase transaction speeds.

Solutions to this issue have been in development for years. There are currently blockchain projects that claim tens of thousands of TPS. Ethereum is rolling out a series of upgrades that include data sampling, binary large objects (BLOBs), and rollups. These improvements are expected to increase network participation, reduce congestion, decrease fees, and increase transaction speeds.

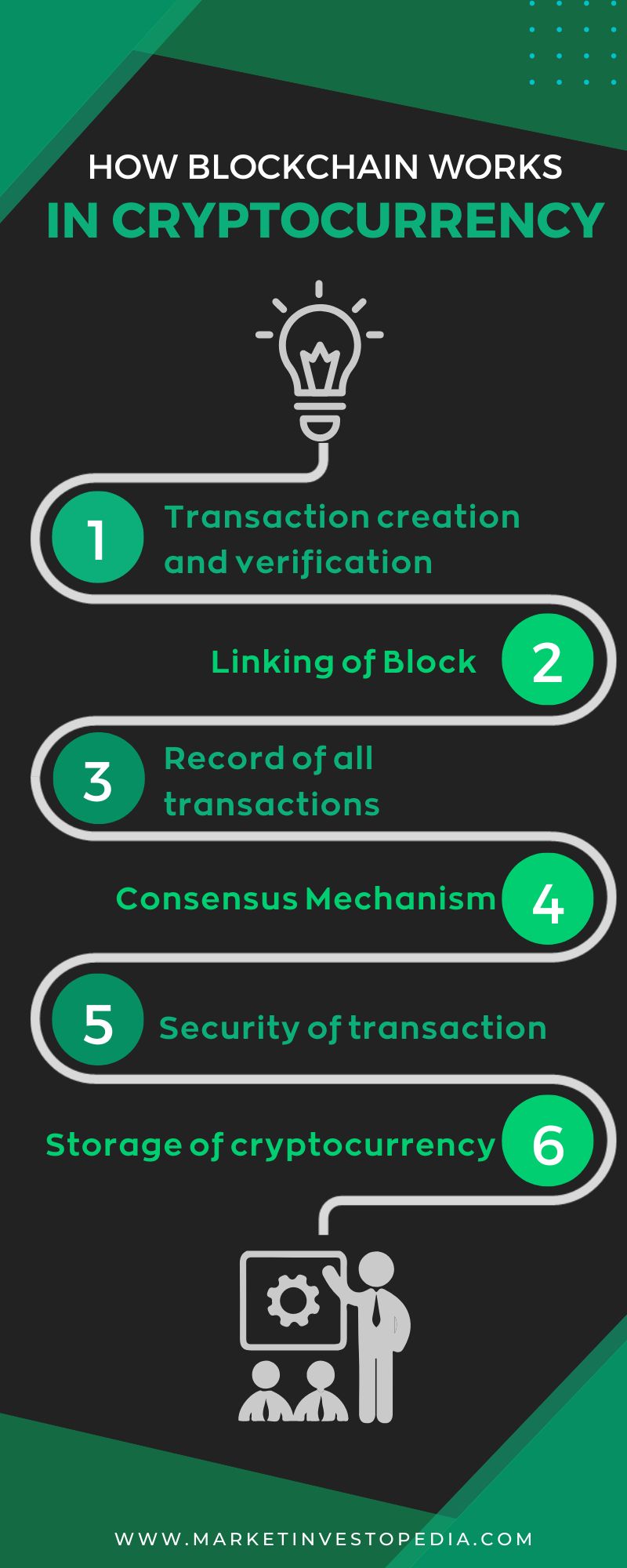

Let’s start with some quick definitions. Blockchain is the technology that enables the existence of cryptocurrency (among other things). Bitcoin is the name of the most recognized cryptocurrency, the one for which blockchain technology, as we currently know it, was created. A cryptocurrency is a medium of exchange such as the US dollar, but is digital and uses cryptographic techniques and its protocol to verify the transfer of funds and control the creation of monetary units.

For an overview into web3, we recommend Demystifying web3 which discusses what business leaders should know about web3, its potential, and what no regrets decisions you can make to prepare. Here are two more recommendations.

Financial tokens are digital assets that support economic activities such as lending, borrowing, trading, and yield generation within decentralised finance (DeFi) ecosystems. These tokens often represent access to specific financial services, act as incentives for participation, or enable protocol-level fee structures. Many of them are native to DeFi platforms and play a central role in shaping on-chain financial products.

Blockchain and DLTs could create new opportunities for businesses by decreasing risk and reducing compliance costs, creating more cost-efficient transactions, driving automated and secure contract fulfillment, and increasing network transparency. Let’s break it down further:

Do all cryptocurrencies use blockchain

This decentralized approach ensures that no single party can manipulate the system. It also makes blockchain inherently resistant to hacking, as changing one part of the blockchain would require altering the entire chain, which would be practically impossible.

There are four main types of blockchain networks: public blockchains, private blockchains, consortium blockchains and hybrid blockchains. Each one of these platforms has its benefits, drawbacks and ideal uses.

Leading the pack of the richest crypto billionaires in the world is Changpeng Zhao, popularly known as CZ. He founded Binance, the largest cryptocurrency exchange globally by trading volume, underlining his prominent position in the crypto sphere .

Experts are looking into ways to apply blockchain to prevent fraud in voting. In theory, blockchain voting would allow people to submit votes that couldn’t be tampered with as well as would remove the need to have people manually collect and verify paper ballots.

What is the market cap of all cryptocurrencies

Top cryptocurrencies such as Bitcoin and Ethereum employ a permissionless design, in which anyone can participate in the process of establishing consensus regarding the current state of the ledger. This enables a high degree of decentralization and resiliency, making it very difficult for a single entity to arbitrarily change the history of transactions.

The two major categories of cryptocurrencies are Proof-of-Work and Proof-of-Stake. Proof-of-Work coins use mining, while Proof-of-Stake coins use staking to achieve consensus about the state of the ledger.

A cryptocurrency’s market cap increases when its price per unit increases. Alternatively, an increase in circulating supply can also lead to an increase in market cap. However, an increase in supply also tends to lead to a lower price per unit, and the two cancel each other out to a large extent. In practice, an increase in price per unit is the main way in which a cryptocurrency’s market cap grows.

Even though market cap is a widely used metric, it can sometimes be misleading. A good rule of thumb is that the usefulness of any given cryptocurrency’s market cap metric increases in proportion with the cryptocurrency’s trading volume. If a cryptocurrency is actively traded and has deep liquidity across many different exchanges, it becomes much harder for single actors to manipulate prices and create an unrealistic market cap for the cryptocurrency.

Bitcoin is the most popular cryptocurrency and enjoys the most adoption among both individuals and businesses. However, there are many different cryptocurrencies that all have their own advantages or disadvantages.