The Impact of Cryptocurrency on Modern Finance and Society

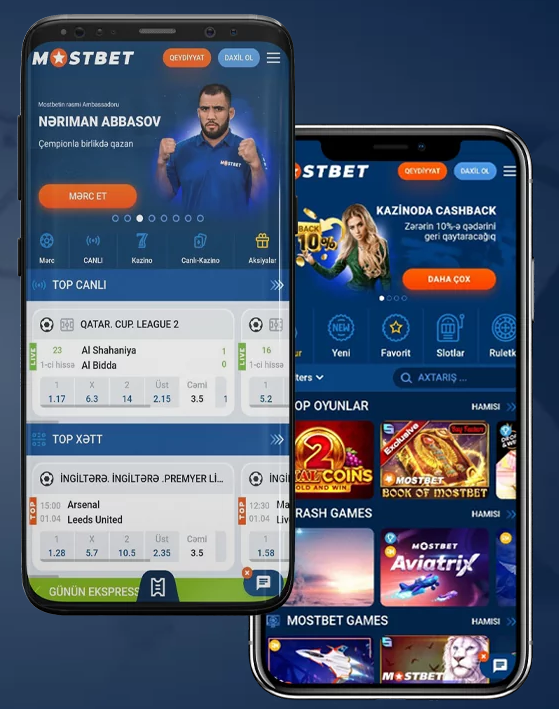

The emergence of cryptocurrencies has significantly transformed the landscape of finance and society as a whole. From the creation of Bitcoin in 2009 to the rise of numerous altcoins, the impact of cryptocurrency is profound and multifaceted. This article explores the various dimensions of how cryptocurrencies are influencing contemporary finance, investing practices, and societal norms. For those interested in exploring the world of online gaming and betting, you can also check out The Impact of Cryptocurrency on Online Casinos in Bangladesh Mostbet লগইন, which showcases the integration of modern technologies in entertainment.

1. Introduction to Cryptocurrency

Cryptocurrency is a digital or virtual form of currency that employs cryptography for security. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology. The most well-known cryptocurrency, Bitcoin, paved the way for thousands of other cryptos, commonly referred to as altcoins. The decentralized nature of cryptocurrencies allows for peer-to-peer transactions without the need for intermediaries, such as banks or governments.

2. Financial Inclusion and Accessibility

One of the most significant impacts of cryptocurrencies is their potential to enhance financial inclusion. Billions of people globally remain unbanked—without access to traditional banking services. Cryptocurrencies offer an alternative for these individuals, providing a means to store and transfer value without relying on conventional banks. Mobile phone ownership in developing countries can enable individuals to participate in the cryptocurrency ecosystem, allowing them to transact, save, and invest.

3. Investment and Speculation

The rise of cryptocurrencies has also transformed investment practices. Cryptocurrencies gained popularity as speculative assets, attracting a new class of investors motivated by rapid price appreciation. The volatility of cryptocurrencies attracts both seasoned investors and newcomers to the market, creating opportunities for substantial gains—or losses. This speculative nature poses risks, leading to regulatory discussions aimed at protecting investors from potential market manipulation and fraud.

4. Blockchain Technology and Its Applications

At the heart of cryptocurrencies lies blockchain technology, a decentralized ledger that records all transactions across a network of computers. This technology has far-reaching implications beyond cryptocurrencies. Industries such as supply chain management, healthcare, and real estate are exploring blockchain for enhanced transparency and security. By reducing fraud and increasing operational efficiency, blockchain could revolutionize various sectors of the economy.

5. Impact on Traditional Financial Institutions

The rise of cryptocurrencies poses challenges to traditional financial institutions. Banks and financial services are reevaluating their roles in light of the increasing popularity of decentralized finance (DeFi) platforms, which provide financial services without intermediaries. As more participants engage with cryptocurrencies, traditional institutions must adapt or risk obsolescence. Some banks are exploring ways to integrate cryptocurrencies into their operations, offering services such as custodial solutions and transaction facilitation.

6. Regulatory Landscape

As the cryptocurrency market expands, regulators worldwide grapple with the need to create a framework that balances innovation with consumer protection. Countries differ widely in their approach to cryptocurrency regulation, with some adopting a friendly stance while others impose restrictions or outright bans. Proper regulation can provide clarity and confidence to investors while safeguarding against fraud and ensuring compliance with anti-money laundering (AML) efforts.

7. Environmental Concerns

The environmental impact of cryptocurrency mining, particularly proof-of-work coins like Bitcoin, has come under scrutiny. Mining consumes significant energy resources, leading to concerns about carbon footprints and sustainability. In response, some cryptocurrencies are migrating to more energy-efficient consensus mechanisms, such as proof-of-stake. The industry is increasingly focusing on eco-friendly solutions to address these pressing concerns, aiming to reduce the environmental impact while maintaining network security.

8. Cryptocurrencies in Global Economies

As cryptocurrencies gain traction, their influence on global economies is becoming more evident. Some countries are exploring central bank digital currencies (CBDCs), which leverage blockchain technology to create government-backed digital currencies. The potential adoption of CBDCs could reshape monetary policy, payment systems, and financial stability. However, the coexistence of traditional bank currencies and cryptocurrencies presents various challenges and opportunities for policymakers.

9. Societal Perceptions and Cultural Impact

The rise of cryptocurrencies has sparked cultural changes, influencing how people perceive money, investment, and technology. Cryptocurrencies have fostered a new community of advocates and enthusiasts who emphasize decentralization and financial sovereignty. This cultural shift is reshaping societal norms, encouraging discussions around the nature of money and value. Events like cryptocurrency conferences and meetups bring together like-minded individuals to share ideas, experiences, and insights into this rapidly evolving sector.

10. Future Prospects of Cryptocurrency

The future of cryptocurrency is promising yet uncertain. As technology matures and more participants enter the market, cryptocurrencies could become a more integral part of everyday life. Innovations in blockchain, smart contracts, and decentralized finance will likely continue to evolve, paving the way for new use cases and applications. While challenges remain, the resilience of the cryptocurrency community suggests that it will adapt and thrive. The potential for cryptocurrencies to revolutionize finance, investment, and societal interactions remains an exciting prospect for the years to come.

Conclusion

The impact of cryptocurrency on modern finance and society is undeniable. From financial inclusion to investment transformation, the emergence of cryptocurrencies has sparked significant changes across various domains. As challenges like regulation, environmental concerns, and competition with traditional financial institutions persist, the cryptocurrency landscape will continue to evolve. Embracing innovation while addressing these challenges could lead to a future where cryptocurrencies play a central role in shaping economic and societal structures.